How Do Banks Trade Forex

How to brand coin in forex?

I'm often mystified in my educational forex articles why then many traders struggle to brand consistent money out of forex trading. The respond has more than to do with what they don't know than what they do know. After working in investment banks for 20 years many of which were equally a Chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and brand trading decisions.

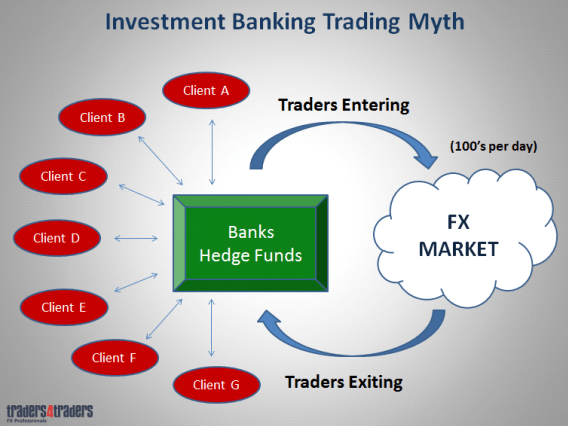

Why? Banking company traders but brand up v% of the total number of forex traders with speculators bookkeeping for the other 95%, but more importantly that v% of bank traders account for 92% of all forex volumes. And so if you don't know how they merchandise, then you lot're simply guessing. Commencement let me bust the first myth about forex traders in institutions. They don't sit down there all day banging away making proprietary trading decisions. Most of the time they are only transacting on behalf of the banks customers. It'south commonly referred to every bit 'clearing the period". They may perform a few thousand trades a day merely none of these are for their proprietary volume

How do banks trade forex?

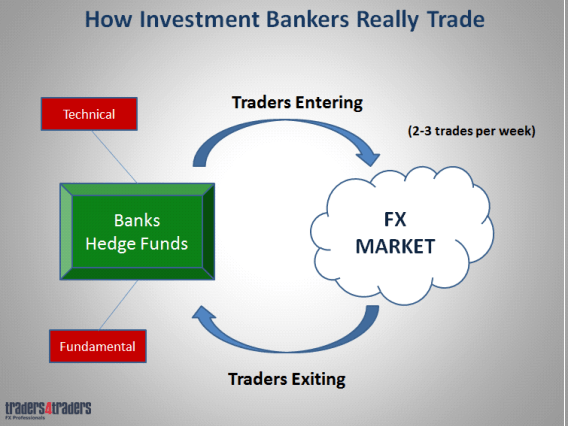

They really simply perform 2-three trades a week for their own trading account. These trades are the ones they are judged on at the stop of the year to meet whether they deserve an boosted bonus or not.

Then as yous can encounter traders at the banks don't sit in that location all 24-hour interval trading randomly 'scalping' trying to make their budgets. They are extremely methodical in their approach and make trading decisions when everything lines upwardly, technically and fundamentally. That's what you need to know!

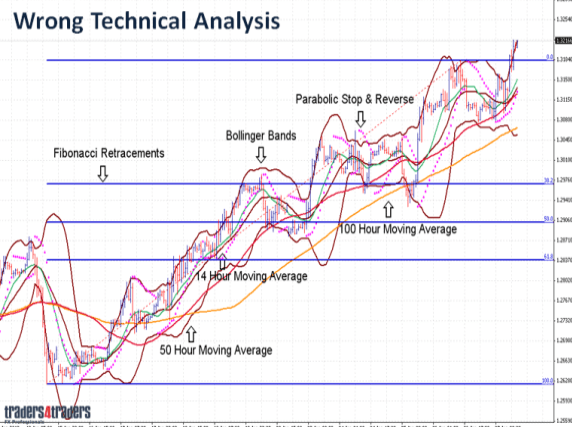

As far every bit technical assay goes information technology is extremely simple. I am often dumbfounded by our client's charts when they first come to usa. They are often littered with mathematical indicators which not only have significant 3-4 hour time lags but also often contradict each other. Trading with these indicators and this approach is the quickest mode to rip through your trading capital letter.

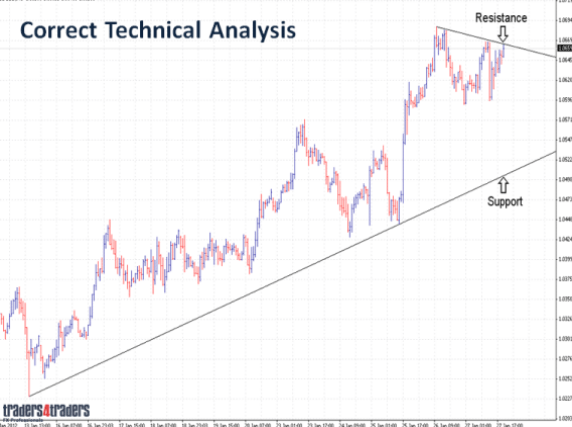

Depository financial institution trader's charts look nothing like this. In fact they are completely the reverse. All they want to know is where the key critical levels. Don't forget these indicators were developed to try and predict where the market is going. The depository financial institution traders are the market. If you understand how they trade so you don't demand any indicators. They make dissever second decisions based on fundamental technical and key changes. Understanding their technical analysis is the first footstep to becoming a successful trader. You'll exist trading with the marketplace not against it.

What it all comes down to is simple support and resistance. No clutter, nada to change their trading decisions. Simple, effective and highlighting the key levels. I'm not going to go into the ins and outs of where they actually enter the market, just let me say this: information technology's not where yous think. The trendlines are simply there to betoken key support and resistance. Entering the market is another discussion all together.

How to brand money in forex?

The key aspect to their trading decisions is derived from the economic fundamentals. The primal properties of the market consists of three major areas and that'southward why it's hard to pivot point currency direction sometimes.

When y'all have the political situation countering the central bank announcements currency management is somewhat disjointed. Merely when there are no political issues and formulated central bank policy acting in accord with the economic information, that's when we become pure currency management and the big trends emerge. This is what bank traders wait for.

The fundamental aspect of the marketplace is extremely complex and it tin accept years to principal them. This is a major area we concentrate on during our ii twenty-four hours workshop to ensure traders have a complete understanding of each area. If you lot understand them you are set up for long term success equally this is where currency direction comes from.

There is a lot of money to exist fabricated from trading the economical data releases. The key to trading the releases is twofold. First, having an excellent understanding of the fundamentals and how the various releases impact the market place. Secondly, knowing how to execute the trades with precision and without hesitation. If y'all can get a command of this aspect of trading and accept the confidence to trade the events and then you're truly set up to make huge capital letter advances. Later all it is these economic releases which really straight the currencies. These are the same economic releases that central banks formulate policy around. So by post-obit the releases and trading them yous not only know what's going on with regards cardinal bank policy but you'll also be building your capital letter at the same time.

Now to be truly successful you demand an extremely comprehensive capital management system that not only protects you during periods of uncertainty just also pushes you forward to experience capital expansion. This is your unabridged business plan so it's important you get this downward pat first.

Our stringent capital letter management system perfectly encompasses your risk to rewards ratios, uppercase controls too as our trade plan – entry and exits. This mode when you're trading, all your concerned about is finding entry levels. Having such a arrangement in place will also convalesce the stresses of trading and allow you to go most your twenty-four hours without spending endless hours monitoring the market.

I tin tell you near traders at banks spend well-nigh of the day wandering around the dealing room chatting to other traders or going to lunches with brokers. Rarely are they in front end of the calculator for more than a few hours. You should exist taking the same approach. If you sympathise the technical and key aspects of the marketplace and accept a comprehensive professional person capital management arrangement then you can.

From here information technology simply takes a unproblematic understanding of the key strategies to apply and where to employ them and away you go. Trust me you lot will experience more majuscule growth then you e'er have before if you know how the banking concern traders trade. Many traders accept tried to replicate their methods and I've seen numerous books on "how to beat the bankers". Simply the bespeak is yous don't want to be chirapsia them but joining them. That manner you lot will be trading with the market not confronting it.

Then to conclude let me say this: At that place are no miraculous secrets to trading forex. There are no special indicators or robots that tin can mimic the dynamic forex market. You simply demand to understand how the major players (bankers) trade and analyse the market. If y'all get these aspects correct then your well on the style to success.

How you brand money trading and investing in the markets is no different than how you make coin ownership and selling annihilation in life and this bones concept never changes. The only difference between Costco and JP Morgan is what they sell, non how they operate or brand and lose money. Costco buys the products at wholesale prices, marks them up and sells to us at retail prices. JP Morgan gets stocks and bonds at wholesale prices, marks them up and sells to usa at retail prices. It is actually the exact same business model, just a different production.

The risk of loss in Forex trading can exist substantial. You should, therefore, carefully consider whether such trading is suitable for you in the calorie-free of your financial status. The high degree of leverage that is oftentimes obtainable in Forex trading can piece of work against y'all as well equally for you. The use of leverage can lead to big losses too as gains. Past functioning is not indicative of future results.

Source: https://www.fxstreet.com/education/making-money-in-forex-is-easy-201312050000

Posted by: dexterhined1936.blogspot.com

0 Response to "How Do Banks Trade Forex"

Post a Comment